ETF Bitcoin/Ethereum/Solana

Institutional Capital Analysis: The 💰 ETF Tab

Since the approval of Spot ETFs (Exchange Traded Funds) in the United States, market structure has evolved. Cryptocurrency markets now see significant participation from large-scale asset managers.

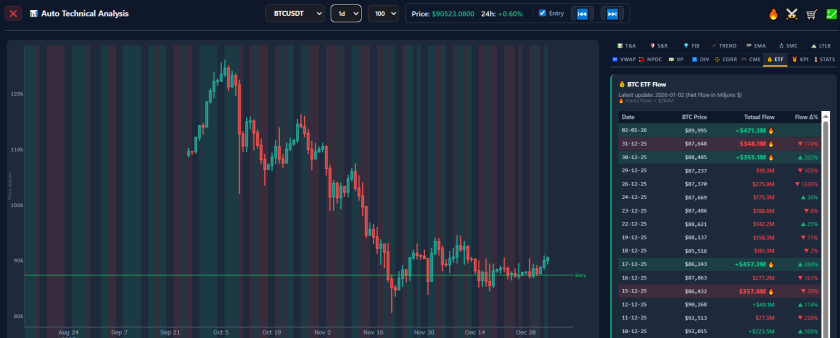

The 💰 ETF tab in AiTraderView is designed to aggregate and visualize this data. It provides an overview of daily Crypto ETF Flows, allowing analysts to monitor the net movement of capital into or out of these regulated investment vehicles. Currently, the system tracks flows for the three major assets with significant institutional products: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

What Are Crypto ETF Flows?

A Spot ETF is a financial product where the provider (e.g., BlackRock’s IBIT) generally holds the underlying cryptocurrency to back the shares of the fund.

- Inflow (Creation): When demand for ETF shares exceeds supply, the fund manager typically issues new shares and purchases the underlying asset (BTC, ETH, or SOL) to back them. In market theory, this creates buying pressure.

- Outflow (Redemption): When investors sell ETF shares and supply exceeds demand, the fund manager redeems shares and sells the underlying asset. This creates selling pressure.

The 💰 ETF tab visualizes the Net Flow—the daily balance of these creation and redemption activities.

Supported Assets

The tab focuses on assets with accessible institutional flow data:

- Bitcoin (BTC): As the market leader, Bitcoin ETF flows are often analyzed as a proxy for broader crypto market sentiment.

- Ethereum (ETH): Tracking ETH flows helps identify institutional demand for smart contract platforms.

- Solana (SOL): Monitoring SOL-related products provides data on institutional appetite for high-beta alternative assets.

How to Read the 💰 ETF Tab

The data is presented in chart and table formats covering recent trading sessions. Correct interpretation requires understanding specific data characteristics.

1. Net Flow (The Daily Balance) This metric represents the total inflows minus total outflows from major providers.

- Green Bars (Positive): Indicates net capital allocation (Inflow). Technical analysts view this as a sign of accumulation.

- Red Bars (Negative): Indicates net capital redemption (Outflow). This suggests institutional reduction of exposure.

2. The T-1 Reporting Cycle It is vital to note that ETF data originates from traditional equity markets, which operate on fixed hours (Monday–Friday). Unlike the 24/7 crypto market, ETF data typically reflects a T-1 (Trade Date + 1) reporting cycle.

- Utility: While the data is not real-time to the second, it provides a view of the prevailing trend. Institutional allocation strategies often play out over days or weeks, rather than hours.

3. Cumulative Flow The tool may visualize the cumulative trend line.

- Interpretation: A rising cumulative line indicates that the total quantity of the asset held by ETFs is increasing over time. Divergence analysis involves comparing this line to price action (e.g., Price flat vs. Cumulative Flows rising).

Analytical Concepts Using ETF Flows

Analyzing fund flows allows traders to align their strategies with broader market liquidity trends.

Concept 1: Trend Confirmation

- The Setup: Technical analysis suggests a potential breakout.

- The Check: Review the 💰 ETF tab for the asset. A streak of consecutive positive flow days provides Fundamental Confluence, suggesting the price move is supported by actual capital injection rather than just speculative leverage.

Concept 2: Identifying Exhaustion (Reversal)

- The Setup: An asset has been in a corrective downtrend.

- The Check: Monitor the magnitude of the red bars (outflows). If outflows are diminishing significantly or flipping to net inflows despite low prices, it is often interpreted as Seller Exhaustion or potential accumulation at value levels.

Concept 3: Macro Sentiment (Risk-On vs. Risk-Off) Crypto ETF Flows often reflect broader US equity market sentiment.

- High Inflows: Generally correlate with a “Risk-On” macro environment where capital is deploying into growth assets.

- High Outflows: Generally correlate with a “Risk-Off” environment where capital is fleeing to cash or treasuries.

Conclusion

The price discovery mechanism for Bitcoin, Ethereum, and Solana is now partially influenced by regulated investment vehicles. The 💰 ETF tab in AiTraderView democratizes access to this institutional data.

By integrating Crypto ETF Flows into a routine, analysts can evaluate whether price movements are backed by significant net capital changes or if they are driven by short-term market noise.

⚠️ RISK WARNING & AI DISCLOSURE

- This information is generated by Artificial Intelligence (AI) and complex algorithms. While advanced, these systems can contain errors or inaccuracies and are for educational purposes only.

- Technical analysis provides no guarantees; this information is purely informative.

- All discussed scenarios are hypothetical and do not constitute predictions or expectations.

- Past performance is not an indicator of future results.

- This is not financial advice and is not intended as a call-to-action for the reader.

- No implicit direction is claimed, and no specific behavior of market participants is suggested.