The cryptocurrency market recently experienced a significant volatility event, with Bitcoin BTC/USD retracing from recent highs near $112,000 to a local bottom of approximately $61,000.

As the price currently hovers around $70,395, traders are closely monitoring whether this move represents a definitive bottom or a temporary “Dead Cat Bounce.”

Below is a technical deep dive into the daily price action and underlying orderflow data to determine the market’s next potential direction.

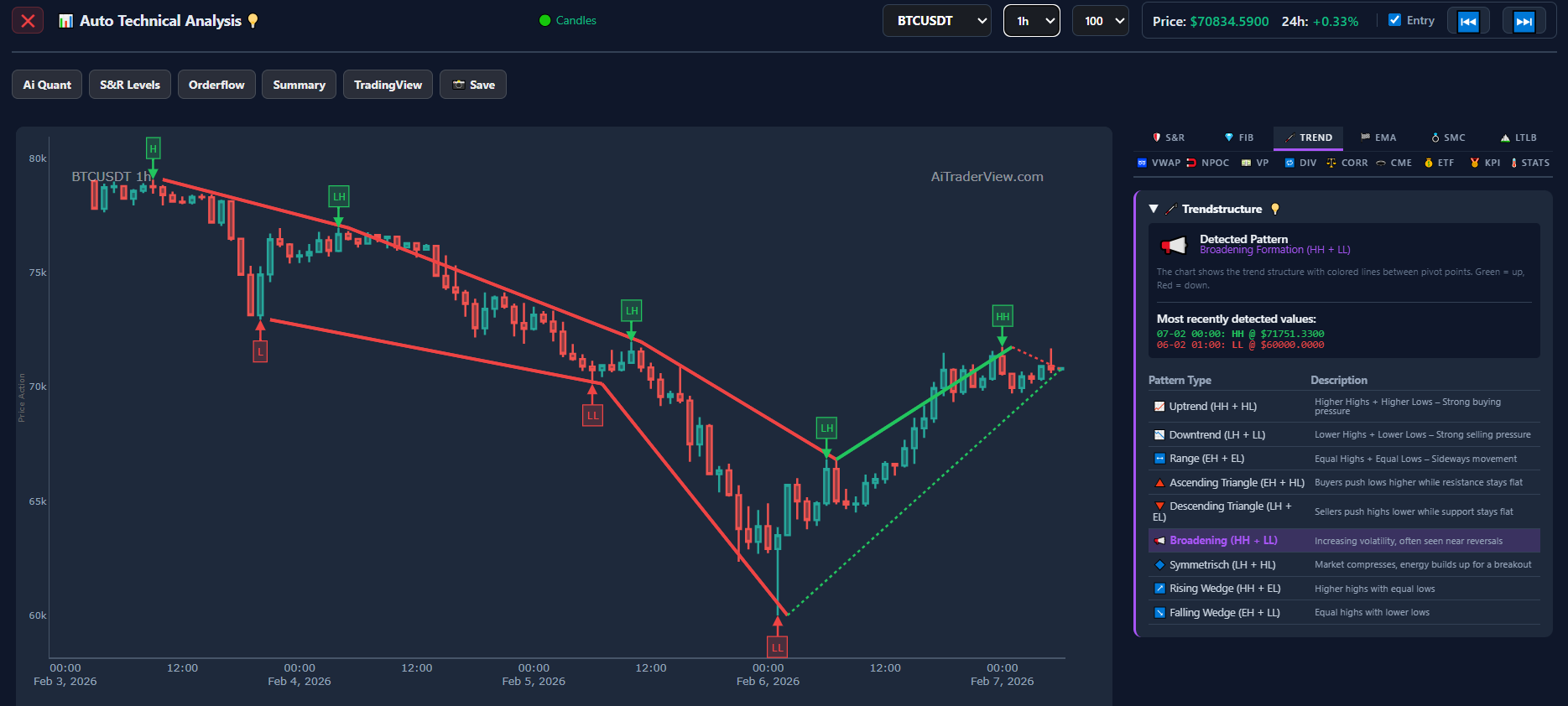

1. The Daily Chart: Bullish Reversal Patterns?

The daily timeframe reveals several classic technical indicators suggesting that the selling pressure may have reached an exhaustion point.

- Candlestick Anatomy: The recent price action features a prominent long lower shadow (wick) reaching down to the $61,000 zone. This indicates a massive “rejection” of lower prices, where buyers stepped in aggressively.

- Bullish Belt Hold Concept: While crypto markets lack traditional “gaps,” the momentum of the recovery from the $61,000 low satisfies the Bullish Belt Hold concept. The lower shadow serves as a testament to the demand found at those levels.

- Piercing Pattern Potential: The current green daily candle is attempting to “pierce” the previous large red candle. For a confirmed Piercing Pattern, the price must close above the 50% midpoint of the previous candle’s body, which sits approximately between $76,000 and $77,000.

- Bollinger Band Deviation: The price dropped significantly below the lower Bollinger Band, creating an “oversold” condition. Historically, such extreme deviations often lead to a “mean reversion” back toward the center of the bands.

2. Orderflow Analysis: The “Big Flush”

To understand if this recovery is sustainable, we must look at the Orderflow Snapshot from February 7, 2026.

Liquidations and Open Interest

- 📉 Massive Long Liquidations: The crash was fueled by a “long squeeze,” where over-leveraged buyers were forced to sell. This is visible in the massive red spikes in the Coin Liquidations chart.

- 🔄 Open Interest Reset: The Open Interest (OI) — the total number of outstanding contracts — saw a sharp decline during the drop. This “reset” is often healthy for the market, as it removes “weak hands” and reduces speculative froth.

Funding Rates and CVD

- 💸 Negative Funding: During the deepest part of the dip, funding rates turned negative. This means “short” sellers were paying “longs” to keep their positions open, suggesting the market was temporarily too bearish.

- 📊 Cumulative Volume Delta (CVD): The CVD has recently shown green histogram bars, indicating that market participants are now using “market buy” orders to enter positions, providing the necessary momentum for a bounce.

3. V-Recovery vs. Dead Cat Bounce: Key Levels

The primary question remains: is this a V-Recovery or a Dead Cat Bounce?

| Feature | ✅ V-Recovery Signs | ⚠️ Dead Cat Bounce Signs |

| Volume | High and sustained on the move up. | Fading volume as price rises. |

| Critical Resistance | Convincing break above $77,000. | Rejection at the $77k – $83k zone. |

| Market Structure | Forming Higher Highs on 4H/1H charts. | Failure to break the previous local high. |

💡 Technical Note:

The Volume Profile shows a significant “Point of Control” (POC) much higher than current prices. If the price fails to regain the $77,000 level, those who bought near the top may use this bounce to exit “break-even,” creating a classic “Dead Cat” scenario.

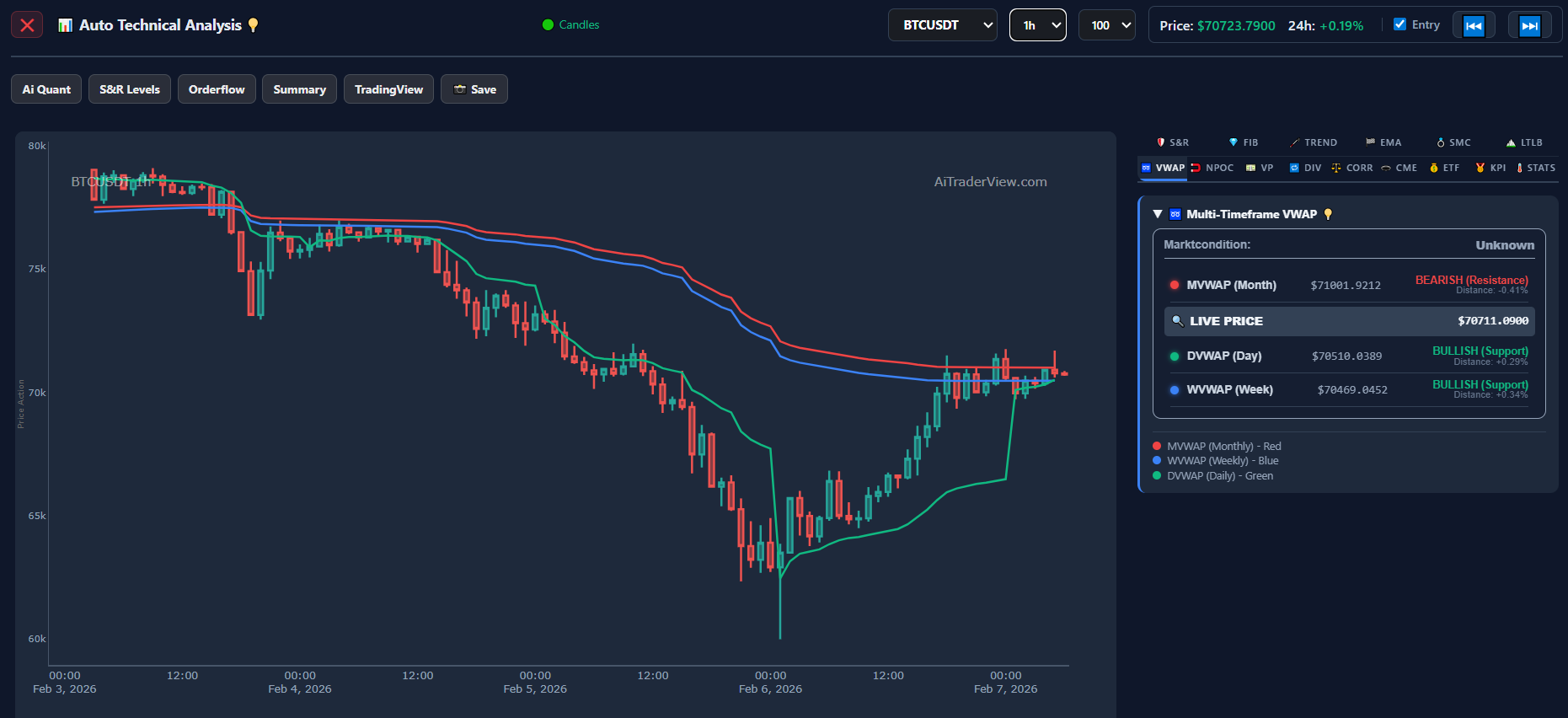

4. Intraday Focus: The Battle of the VWAPs

Zooming into the 1-hour timeframe, the V-shaped recovery becomes visually evident, but the price is currently facing a critical technical test known as a “VWAP Squeeze.”

The chart highlights a convergence of Volume Weighted Average Prices (VWAP) across different timeframes, acting as invisible dynamic support and resistance levels.

- 🔴 The Ceiling (Resistance): The Monthly VWAP (MVWAP) sits at $71,001. As seen in the data panel, this level is currently flagged as “BEARISH.” For the bulls to regain full control, a clean 1-hour candle close above this red line is non-negotiable.

- 🟢 The Floor (Support): Directly below the price, we have a strong confluence of support. The Daily VWAP ($70,510) and the Weekly VWAP ($70,469) are providing a “safety net.”

What does this mean? The price is currently “sandwiched” between $70,400 and $71,000. If buyers can defend the Weekly/Daily VWAP stack and push through the $71,001 Red Wall, it confirms that institutional buyers are willing to pay a premium to chase the price higher, likely opening the door to the $77k target mentioned earlier.

Conclusion and Market Outlook

The combination of a Volume Climax and Negative Funding suggests that a local bottom has likely been formed at $61,000.

However, the path to recovery faces two distinct tests.

- Immediate Term: Bulls must first decisively reclaim the Monthly VWAP at $71,001.

- Confirmation: Once cleared, the focus shifts to a daily close above $77,000, which would validate the Piercing Pattern and confirm a true V-shaped recovery.

Failure to hold the local VWAP support at $70,400 could delay this recovery and risk a retest of lower levels.

Disclaimer: This article is for informational and technical analysis purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency markets are highly volatile. Under MiCAR and SEC guidelines, readers are encouraged to perform their own due diligence or consult a certified financial advisor before making any investment decisions.

⚠️ RISK WARNING & AI DISCLOSURE

- This information is generated by Artificial Intelligence (AI) and complex algorithms. While advanced, these systems can contain errors or inaccuracies and are for educational purposes only.

- Technical analysis provides no guarantees; this information is purely informative.

- All discussed scenarios are hypothetical and do not constitute predictions or expectations.

- Past performance is not an indicator of future results.

- This is not financial advice and is not intended as a call-to-action for the reader.

- No implicit direction is claimed, and no specific behavior of market participants is suggested.