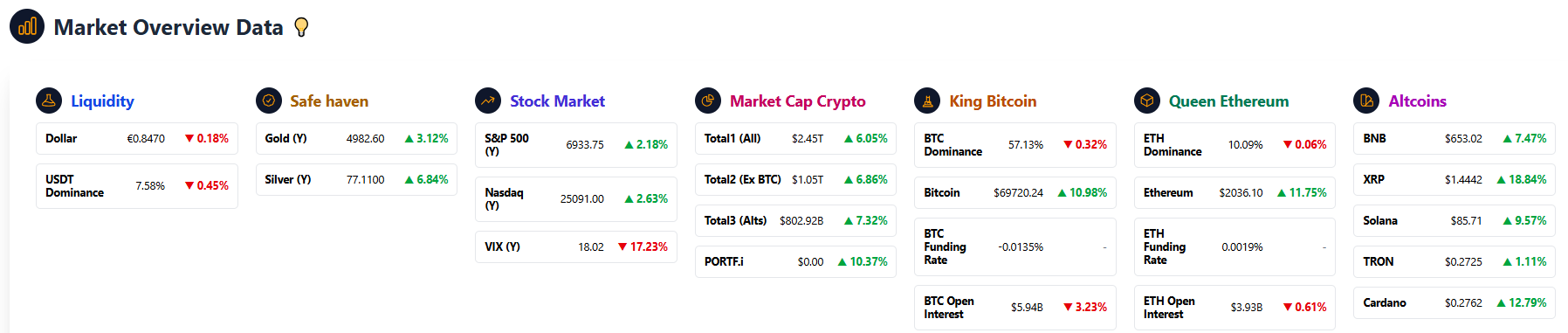

The cryptocurrency market shows a short-term rebound in early February 2026 after a prolonged downturn. Bitcoin is trading near $70,000, Ethereum has moved back above $2,000, and major altcoins such as XRP, ADA, and Solana are posting double-digit daily gains. Despite this recovery, overall sentiment remains cautious as macroeconomic uncertainty and regulatory developments continue to shape the market.

Market Overview

The cryptocurrency market ends the first week of February with heightened volatility and a notable short-term rebound, following a period of sharp declines earlier in the year. While overall market sentiment remains cautious, several leading digital assets have recorded double-digit percentage gains over the past 24 hours, suggesting renewed trading activity after prolonged selling pressure. Despite this recovery, total market capitalization remains significantly below the peak reached in October 2025, underlining that the broader market is still in a consolidation phase.

The recent price movements appear to be driven by a combination of short-term positioning, reduced liquidation pressure, and temporary stabilization in macroeconomic expectations, rather than a clear shift in long-term fundamentals.

Macroeconomic and Structural Context

The crypto market continues to operate under challenging external conditions. Uncertainty in traditional financial markets, including fluctuations in equity indices and commodities, has kept risk appetite fragile. Cryptocurrencies are still behaving largely as risk-sensitive assets, closely correlated with broader market sentiment.

At the same time, expectations of tight monetary policy in the United States remain a key constraint. The prospect of prolonged restrictive financial conditions continues to limit speculative inflows. Institutional investors, who were major contributors to demand in 2025, have adopted a more defensive stance in early 2026, resulting in lower liquidity across spot and derivatives markets.

Bitcoin (BTC): Stabilization Near Key Levels

Bitcoin (BTC) is currently trading at approximately $69,959.67, up 10.98% on the day. This recovery places Bitcoin back near an important psychological threshold after previously falling to its lowest levels since 2024. While the recent rebound has eased immediate downside pressure, Bitcoin remains well below its 2025 highs.

Market participants note that Bitcoin’s role as a macro-sensitive asset has become more pronounced. Movements are increasingly influenced by liquidity conditions, institutional positioning, and expectations around central bank policy rather than purely crypto-specific narratives.

Ethereum (ETH): Returning Above $2,000

Ethereum (ETH) has regained the $2,000 level, trading around $2,046.00, representing an 11.64% increase. This move follows weeks of sustained weakness and reflects broader market relief rather than project-specific developments.

Fundamentally, Ethereum continues to serve as the backbone of decentralized finance and smart contract infrastructure. However, competitive pressure from alternative blockchains and Layer-2 solutions persists, and capital allocation toward ETH remains selective amid ongoing risk management by investors.

Altcoins: Broad-Based Relief Rally

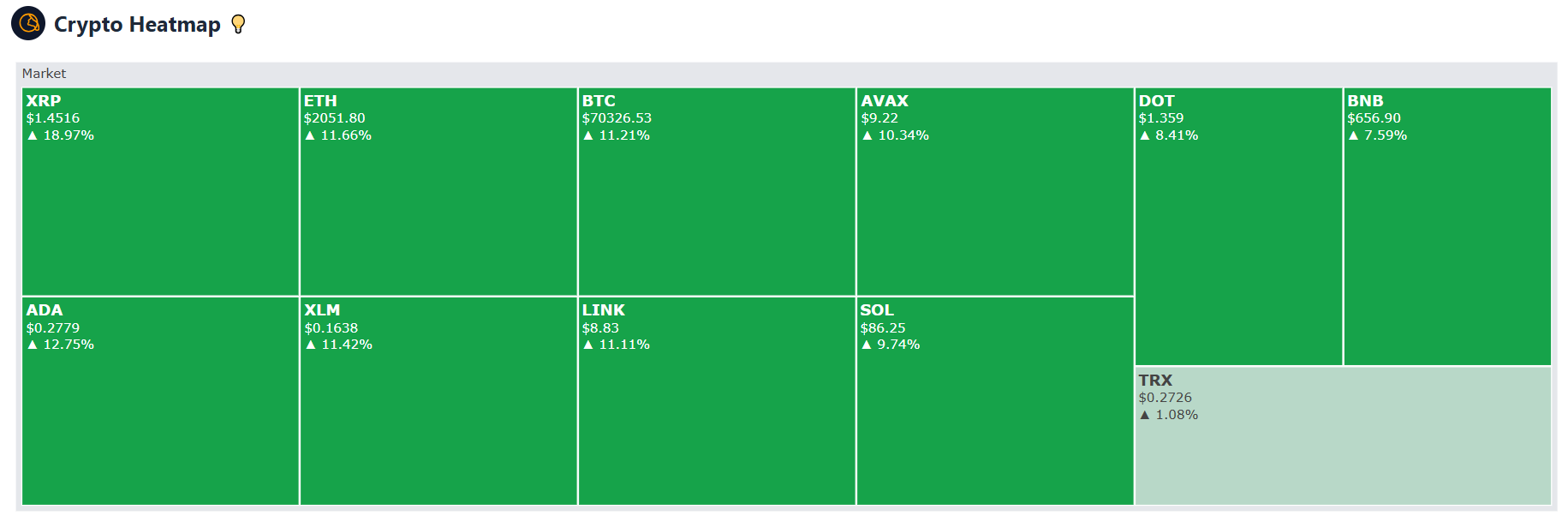

The altcoin segment is showing a coordinated short-term recovery, with many major assets posting strong daily gains:

- XRP is trading at $1.4497, up 19.08%, maintaining its position as a key asset for cross-border payment infrastructure.

- Cardano (ADA) stands at $0.2776, gaining 12.79%, though activity remains subdued compared to previous cycles.

- Solana (SOL) has risen to $86.09, up 9.55%, continuing to attract developer interest despite recent volatility.

- BNB is trading at $654.71, up 7.35%, with performance influenced by both ecosystem usage and regulatory developments surrounding centralized exchanges.

- Polkadot (DOT) is priced at $1.356, up 8.41%, reflecting modest renewed interest in interoperability-focused platforms.

- Avalanche (AVAX) trades at $9.22, up 10.46%, while Chainlink (LINK) has reached $8.82, up 10.98%, supported by its role in blockchain data infrastructure.

- Stellar (XLM) is priced at $0.1643, up 11.56%, benefiting from spillover interest in payment-oriented networks.

Despite these gains, analysts emphasize that volumes remain below 2025 averages, indicating that the move may be driven by short-covering and tactical positioning rather than sustained inflows.

Stablecoins and Market Positioning

During recent volatility, stablecoins continue to play a central role in liquidity management. USDT and USDC remain close to their dollar pegs and are widely used as interim holdings during rapid market moves. Regulatory attention on stablecoins remains elevated globally, particularly in Asia, reinforcing their importance as both a utility and a policy focus.

Regulatory Landscape

Regulation remains a defining factor for the crypto industry in 2026. In the United States, efforts continue to formalize oversight through structured legislation, including clearer definitions of regulatory authority and consumer protection frameworks. These initiatives aim to provide long-term clarity, though short-term uncertainty persists.

In contrast, China maintains a strict prohibition on cryptocurrency-related activities, including unauthorized stablecoin issuance. Meanwhile, the European Union’s MiCA framework is entering full implementation, setting standardized rules across member states and reshaping compliance requirements for market participants.

Market Sentiment and Outlook

Overall sentiment remains measured and defensive. While the current rebound has improved short-term market tone, participants remain focused on macroeconomic signals, regulatory developments, and liquidity conditions. Development across major blockchain ecosystems continues, but capital deployment is cautious.

As 2026 progresses, the cryptocurrency market remains in a transitional phase, balancing technological progress against tighter financial conditions and evolving regulation. The recent price recovery highlights resilience, but broader confidence has yet to fully return.

⚠️ RISK WARNING & AI DISCLOSURE

- This information is generated by Artificial Intelligence (AI) and complex algorithms. While advanced, these systems can contain errors or inaccuracies and are for educational purposes only.

- Technical analysis provides no guarantees; this information is purely informative.

- All discussed scenarios are hypothetical and do not constitute predictions or expectations.

- Past performance is not an indicator of future results.

- This is not financial advice and is not intended as a call-to-action for the reader.

- No implicit direction is claimed, and no specific behavior of market participants is suggested.